EU economic data from the third quarter paints a bleak picture of things to come

Source: Pixabay

Despite hopes for a post-pandemic resurgence and cooling inflation, the European economy is now bracing for stagflation as regional economies show signs of a slowdown.

Economic data from the third quarter paints a bleak picture. Purchasing Managers’ Index (PMI) and the Euro area sentiment indicators have declined in September.

A PMI of 45, the lowest year-to-date, points that the fourth quarter will likely see near-zero growth, if not a contraction. It is questionable whether the European Central Bank (ECB)’s actions will halt this trend.

“ECB officials largely acknowledged that downside risks to growth were starting to materialize, in particular following the flash PMI miss on September 23,” Goldman Sachs said in a note.

Analysts, such as Michael Krautzberger, chief investment officer for fixed income at Allianz Global Investor, are concerned that trade conflicts may hurt the EU. Presidential candidate Donald J. Trump has threatened to impose sanctions if he wins the upcoming US elections. The EU and China could clash after Brussels imposed tariffs earlier this month on Chinese electric vehicle makers.

EU Industrial Slowdown

Consumer confidence remains shaky, business investment is struggling, and the ECB faces mounting pressure to continue cutting interest rates to revive economic activity. Yet, even with additional potential monetary easing, the outlook remains uncertain, prompting ING to downgrade the eurozone’s 2025 outlook to 0.6%.

“The risk of undershooting our target in the long term is now as present as the risk of overshooting it,” French Central Bank governor François Villeroy de Galhau recently stated regarding the monetary policy.

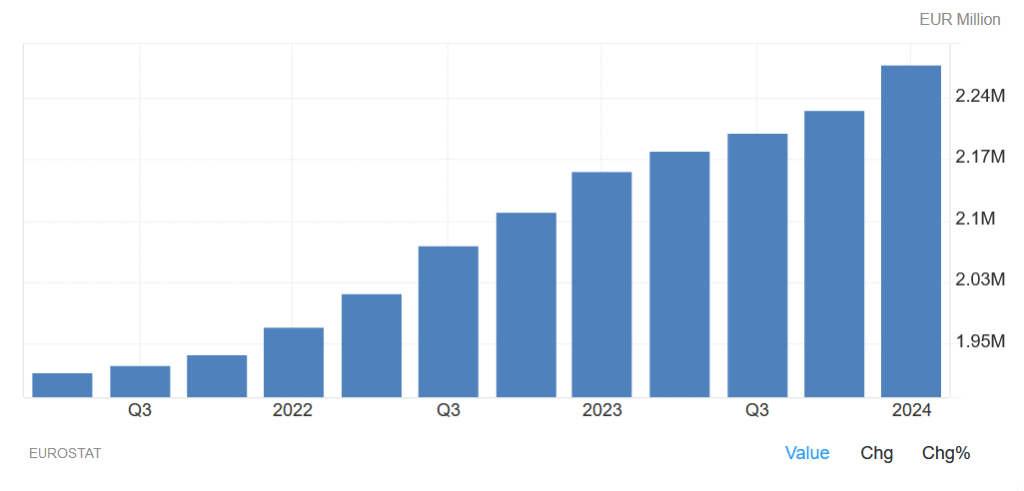

Although real wages have increased due to cooling inflation, the savings rate continues to rise, signaling that European consumers remain cautious about spending. The savings rate has now climbed for the eighth consecutive quarter, reaching 15.66% of disposable income—well above its 25-year average of 13.45%.

This trend indicates that households prioritize savings over consumption, reflecting uncertainty around unemployment and economic instability across the region.

Euro Area Disposable Income, Source: Eurostat/TradingEconomics

Furthermore, Eurozone industrial capacity utilization decreased to 77.7% in Q3, indicating declining activity. The PMI for construction contracted for the 29th month in September, with new orders continuing to fall.

EU Lower Inflation, But Risks Remain

While economic growth is stalling, inflation, the major concern over the past two years, finally shows signs of moderation.

September’s Harmonized Index of Consumer Prices (HICP) showed inflation easing from 2.2% in August to 1.7% in September, with services price inflation decreasing from 4.1% to 3.9% for the same period.

Despite ECB staff projections pointing to a short-term spike in core inflation, which excludes energy and food, analysts expect headline inflation to approach the ECB’s target of 2% by 2025 and fall below the target in 2025.

Even with concerns about potential spikes in energy prices due to geopolitical instability in the Middle East, the overall inflation outlook appears more positive than in recent years.

ECB’s Interest Rate Cut Plans

The downward trend in inflation from 4.3% last September provides the ECB with more room to maneuver in monetary policy. Historically, the central bank has been cautious in cutting interest rates too aggressively.

Still, with inflation under control and the economy weakening, the ECB may now be forced to act more decisively despite pulling the trigger three times since June.

Initially, economists expected the ECB to cut rates once every quarter in 2025. However, given the sharp decline in economic activity and inflation falling in line with targets, the central bank will likely continue cutting rates. Economists polled by Reuters expect another 25-basis point cut in December with a 90% probability.

The ECB’s deposit rate currently sits at 3.25%, and with further rate reductions, it could reach a terminal rate of 2% by mid-2025. While further cuts will provide some relief to businesses and households, the economic outlook for 2025 remains bleak, with the ECB cutting the outlook by 0.1% down to 0.8% for 2024 and from 1.4% to 1.3% in 2025.

This sluggish growth, rising geopolitical tensions, and potential for high energy prices create a volatile environment that could complicate the ECB’s efforts to restore economic stability.

German Companies on Sale

Stagnant growth and deteriorating sentiment have left EU firms out of the investors’ spotlight, translating into lower valuations and prompting strategic foreign interests.

“There are some hopes that recent Chinese policy support will help trade-sensitive markets like Germany,” Krautzberger said in a note on October 15. “But we doubt this will be enough to offset the weak domestic demand picture within the region.”

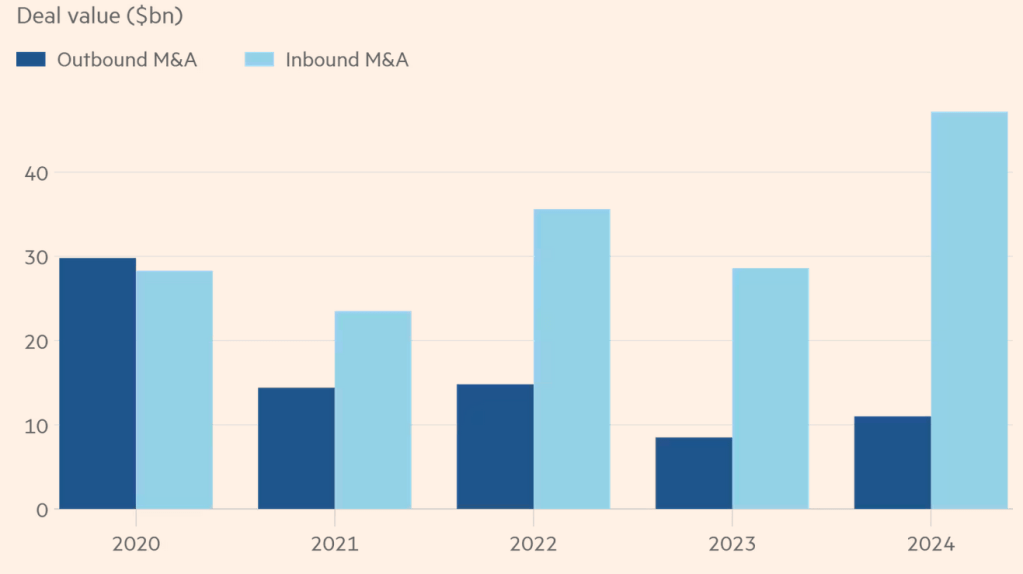

Foreign takeovers of German companies have surged recently, with international firms on a $47.2 billion shopping spree in 2024 alone. High-profile deals, such as Abu Dhabi National Oil Company’s (ADNOC) €14.7b bid for Covestro and Danish logistics giant DSV’s €14.3b acquisition of Schenker, Deutsche Bahn‘s logistics division, show a trend.

German M&A Deals 2020-2024, Source: Bloomberg /FT

These acquisitions are partly driven by German companies becoming smaller players on the global corporate stage, often trading at significant discounts compared to their international counterparts.

The most notable German stock market index, DAX 40, trades at a 40% discount to the S&P 500 for a broad comparison. While such disparities showcase the sentiment, they present an opportunity for foreign investors looking for growth through acquisitions and synergies in the chemical, logistics, and manufacturing sectors.

The German banking sector, too, has seen a marked decline, with Deutsche Bank falling from the 10th-largest bank globally by assets in 2013 to 26th in 2024. Still, acquiring such a systemically important financial institution would likely meet significant regulatory hurdles.

German Stocks to Watch

Bilfinger SE (OTCPK: BFLBF) is an industrial services company with a 145-year tradition. It currently trades at an 8.9x PE ratio and a 0.4x PS ratio. It has a pristine balance sheet with plenty of cash and pays a solid 3.6% dividend with room for growth.

KSB SE (OTC: KSVRF) is another 19th-century legacy industrial player supplying pumps, valves, and related services worldwide. It trades at 7.9x earnings and 0.4x sales. It has barely any debt and strong cash reserves and pays a 3.9% dividend.

HOCHTIEF (OTC: HOCFF) is a construction company that has been in business since 1873 and operates globally. It trades at 12.7x PE ratio and 0.3x PS ratio. It has some debt on the balance sheet, but also considerable cash reserves and pays a 3.7% dividend.

Leave a comment