Given the eurozone’s economic weakness in the eurozone, the ECB should make additional cuts, Villeroy says

French Central Bank governor, François Villeroy de Galhau

The European Central Bank (ECB) may need to adjust its monetary policy to manage the risk of eurozone inflation falling below its 2% target rather than exceeding it, the French central bank governor François Villeroy de Galhau said today.

To stimulate a lagging economy, the ECB cut on Thursday its interest rates by 25 basis points. The move comes on the heels of eurozone inflation falling to 1.7% in September and sluggish growth, particularly in Germany.

“The risk of undershooting our target in the long term is now as present as the risk of overshooting it,” Villeroy said in a statement. “We should continue to reduce the degree of monetary policy restriction in a timely manner.

Source: Euro Area Inflation, Trading Economics

The ECB is shifting its focus from battling inflation to encouraging economic growth, which has been trailing behind the United States for the past two years. The bank maintains a stance that risks to economic growth “remain tilted to the downside.”

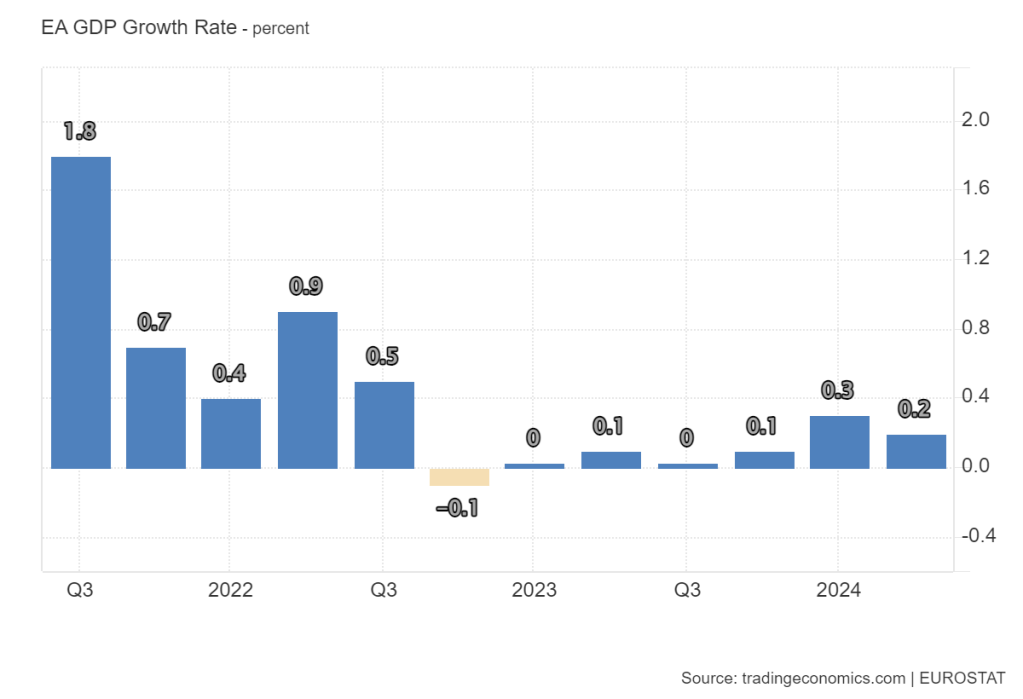

Real GDP growth is forecast to grow by 0.7% in 2024 and 1.2% in 2025, or 0.1 percentage point lower than a previous survey for next year. Given the economic weakness in the eurozone, the ECB should make additional cuts, Villeroy said.

Source: Euro Area Quarterly GDP Growth, Trading Economics

“We believe the disinflationary process is well on track and all the information we received in the last five weeks were heading in the same direction – lower,” ECB President Christine Lagarde said on Thursday during the post-event press conference.

ECB Will Keep Policy Rates ‘Sufficiently Restrictive’

The ECB has not provided specific guidance on future rate changes despite eurozone inflation undershooting its 2% target. Lagarde said that the ECB would keep policy rates “sufficiently restrictive for as long as necessary to achieve” a 2% medium-term target in a timely manner.

The ECB has lowered its deposit rate three times since June to 3.25%, the first back-to-back at such a clip in 13 years. Its latest decision came almost a month after the Federal Reserve announced a bold 50 basis point rate cut.

ECB deposit/refinancing rate 2000-2024, Source: Barrons

“Persistent moderate private investment and consumption with the recent rise in household savings rates in particular justify this new cut,” Villeroy said.

Although incomes rose in the second quarter, “households consumed less, contrary to expectations,” the ECB said on Thursday. “The saving rate stood at 15.7% in the second quarter, well above the pre-pandemic average of 12.9%.”

Source: Euro Area Savings Rate, Trading Economics

ECB Considers Geopolitics When Weighing Rate Decisions

Geopolitics also weigh on the ECB’s decision-making. “The pace must be dictated by an agile pragmatism: in a highly uncertain international environment, we maintain full optionality for our upcoming meetings,” Villeroy said.

EU officials are concerned that Donald Trump may impose new tariffs and turn more isolationist. Trump said in an interview on Tuesday with Bloomberg Editor-in-Chief John Micklethwait in Chicago that his proposals were for the “protection of the companies that we have here.”

The military conflict in Ukraine also shows no signs of ending and fighting in the Middle East still threatens regional stability and global oil shipments. However, concerns about a wider conflict in the region have started to ease.

As the “most open of the major economies,” Europe is more exposed as the global order shifts from “open trade” to “fragmented trade,” ECB Governor Christine Lagarde said on Wednesday.

“The global order we knew is fading,” Lagarde said on Wednesday in a speech to policymakers in Ljubljana. “Open trade is being replaced with fragmented trade, multilateral rules with state-sponsored competition and stable geopolitics with conflict.”

Lagarde did offer a message of optimism for Europe. If Europe approaches these “uncertain times” with “the right spirit, I believe it can be an opportunity for renewal.”

Leave a comment